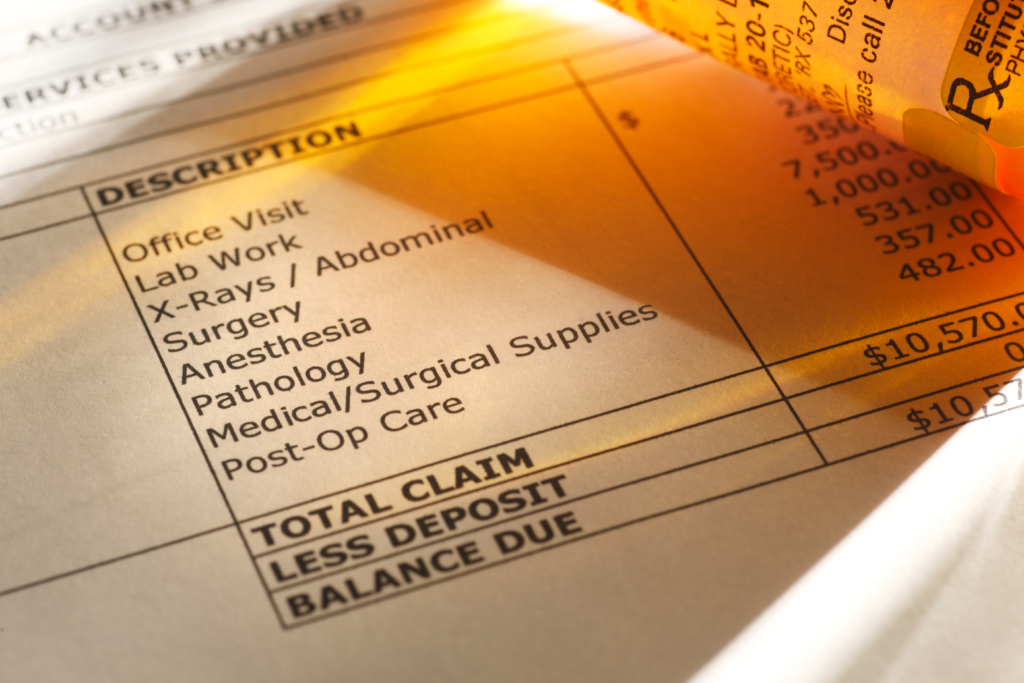

According to a 2020 study by InstaMed, medical bills are confusing to more than 70% of patients. On top of that, 80% of patients were surprised by a medical statement they received.

These numbers are staggering.

Patients should know how much money they will owe for a doctor’s visit or medical procedure beforehand. One way patients can understand their financial responsibilities upfront is by learning about medical billing. This includes knowing what a contractual adjustment is.

This article will teach you everything you need to know about contractual adjustment and more to help you understand your medical bills.

What is Contractual Adjustment?

A contractual adjustment, or contractual allowance, is a portion of a patient’s bill that a doctor or hospital must cancel. They don’t charge for this part of the bill because of their agreements with health insurance companies. It is a write-off.

Third-party insurers and government programs have contracts that state what each party will pay for different medical services. Your insurance or health coverage program is what allows for the contractual adjustment to occur.

Usually, the reimbursement amount is lower than the total billed amount to patients.

Let’s Look at an Example

You go to the doctor, and the appointment costs $100. However, your insurance company has a maximum allowable charge of $70 with the doctor. So, the doctor will receive $70, and the insurance company will write off the remaining $30 from the patient’s bill.

Maximum Allowable Charge

The amount the insurance company agrees to pay for each service is the maximum allowable charge. Yet, as said before, the healthcare industry will charge more for services than insurance companies agree to pay for them.

Why do they charge more when they know the insurance companies have a maximum limit? It seems like contractual adjustments help medical providers lose money if they never receive the total amount.

But, there is more to the story.

Contractrual Adjustment and Insurance

If you don’t have health insurance, you will be responsible for the total amount of the bill. In the above example, that would mean paying $100 out of pocket each time you want to visit that specific doctor.

On the other hand, if you have health insurance, you have an agreement with a company to cover the costs of different services. Healthcare providers and health insurance companies also have these agreements.

As mentioned before, this agreement determines when you will see a contractual adjustment on your medical bill.

But, even with health insurance, your provider won’t cover everything. Unfortunately, this means that sometimes you still have to pay a portion of the bill you receive.

So, what other factors affect the contractual adjustment when working with your health insurance provider?

Deductibles

Most health insurance plans come with a deductible. A deductible is the amount of money you agree to pay before your health insurance plan begins. Some insurance plans have deductibles of a few hundred or a few thousand dollars. However, some deductibles are as high as $10,000.

Let’s say your deductible is $1,000. As per the example above, your doctor’s visit costs $100. However, you have only paid $500 of your deductible for the year.

This means you owe the doctor $100 for the visit because you haven’t met your deductible yet. The $100 you pay to the doctor goes toward your deductible. So, now you owe another $400 out of pocket before your insurance plan begins.

In this case, the doctor will receive the total amount they charge for the appointment ($100), and the billing associate will not make a contractual adjustment.

Healthcare Networks

The company you have insurance with has a network of doctors and hospitals for you to use. The term you will hear is “in-network.” Different insurance plans offered by the company may give you access to other networks.

The doctors and hospitals in your network are cheaper for you to use since they also have a contract with your specific insurance provider. However, there are times when you will need to seek treatment outside of your network.

Suppose there is an emergency, you may need to use a doctor or hospital out-of-network. Additionally, if you’re traveling or need specialized care, you may need to seek an out-of-network provider. When you go out of network, the healthcare provider does not have to accept your insurance.

Even if they do accept your insurance, they can still bill you. This is true even if your insurance company pays in full for your appointment or procedure. Although the laws are changing for 2022, out-of-network healthcare providers can still bill patients to cover the total cost of care.

Billing associates call this balance billing. Next year, healthcare providers will still partake in balance billing except for specific situations, like emergencies.

Looking back at the example, if the doctor you visited is outside your insurance network, the doctor’s office will most likely bill you $100. Your insurance company may decide to cover part of the $100 for you. But, they may also expect you to pay the total amount. In this case, you are not entitled to a contractual adjustment.

Even though seeking healthcare services out-of-network is more expensive, sometimes it is necessary.

What Services Get a Contractual Adjustment?

Having health insurance, meeting your deductible, and seeing an in-network healthcare provider doesn’t mean you automatically will receive a contractual adjustment on your medical bill.

Not all services are subject to a contractual adjustment. Again, this goes back to the agreement between the medical provider and the health insurance company. As from the example, the insurance company may cover your $100 doctor’s appointment based on the contract.

But, if the doctor says they need to run further tests on you, check what kind of insurance coverage you will receive before the doctor runs them. The doctor’s agreement with the health insurance company may only cover the visit and no additional testing.

Someone in the doctor’s office, usually the billing associate, should be able to tell you what kind of coverage you will receive if you need extra services. If you can, always double-check your coverage before receiving care.

It is best not to assume you will have coverage. After all, you don’t want to have a surprise medical bill come in the mail.

More Medical Billing Terms to Know

As you can see, the health insurance industry has many terms that can confuse someone who doesn’t specialize in healthcare. The good news is, you’ve learned these terms so far:

- Contractual adjustment

- Maximum allowable charge

- Deductible

- In-network

- Out-of-network

Aside from what this article has already discussed, you should know a few other medical terms to understand medical billing further. When you receive a medical bill in the mail, you can look for these codes to get more information.

Explanation of Benefits (EOB)

An EOB is a statement from the health insurance company that describes what costs they will cover. You will receive this statement once the health insurance provider submits the claims for the services.

The EOB comes before you receive a bill. Along with the EOB, you will see claim adjustment group codes. These codes show you your payment responsibilities and what the insurance company is going to cover.

Contractual Obligations (CO)

You will see the code CO when an adjustment is due to a joint contractual agreement or an administrative requirement. In other words, this is the code for a contractual allowance.

For example, CO-45 tells how much the provider will write off based on the cost exceeding the contractual amount. On the other hand, CO-54 means some of the doctors or assistants were not covered.

Other Adjustments (OA)

Billing associates use OA when there is an adjustment that doesn’t fall into any other category. For instance, they commonly use code OA-23 to show the impact of prior payment or adjustment.

Payer Initiated Adjustments (PA)

When the insurance company doesn’t think the adjustment is the patient’s responsibility, but there is no agreement between the provider and the insurance company, you will see code PA.

There will be additional information listed if you see this code to explain the situation further.

Patient Responsibility (PR)

Billing associates use code PR for deductibles, coinsurance, and copay. It will also show the amount that the patient needs to pay. For example, PR-1 shows an amount applied to the deductible, whereas PR-2 shows an amount applied to the coinsurance.

Corrects and Reversals (CR)

If there were a decision to change a previously adjusted claim, you would see code CR. It often shows that you will now have some financial responsibility when once you did not.

Understanding Your Healthcare

After all this article talked about, now you are better prepared to know how much you will need to pay for different medical services. Understanding a contractual adjustment is just the first step to knowing your health insurance coverage and payment responsibilities.

Even though healthcare billing is confusing for everyone, you should still seek medical assistance if something is wrong. The frustration of medical billing is not more important than receiving care. Our healthcare specialists at Amazing Healthcare Consultants are available to help you. Don’t hesitate to contact us today to schedule an appointment.